The Ultimate Guide To Clark Wealth Partners

Table of ContentsThe smart Trick of Clark Wealth Partners That Nobody is Talking AboutIndicators on Clark Wealth Partners You Need To KnowThe smart Trick of Clark Wealth Partners That Nobody is DiscussingThe Clark Wealth Partners StatementsClark Wealth Partners Things To Know Before You BuyThe Best Guide To Clark Wealth PartnersExcitement About Clark Wealth PartnersOur Clark Wealth Partners Ideas

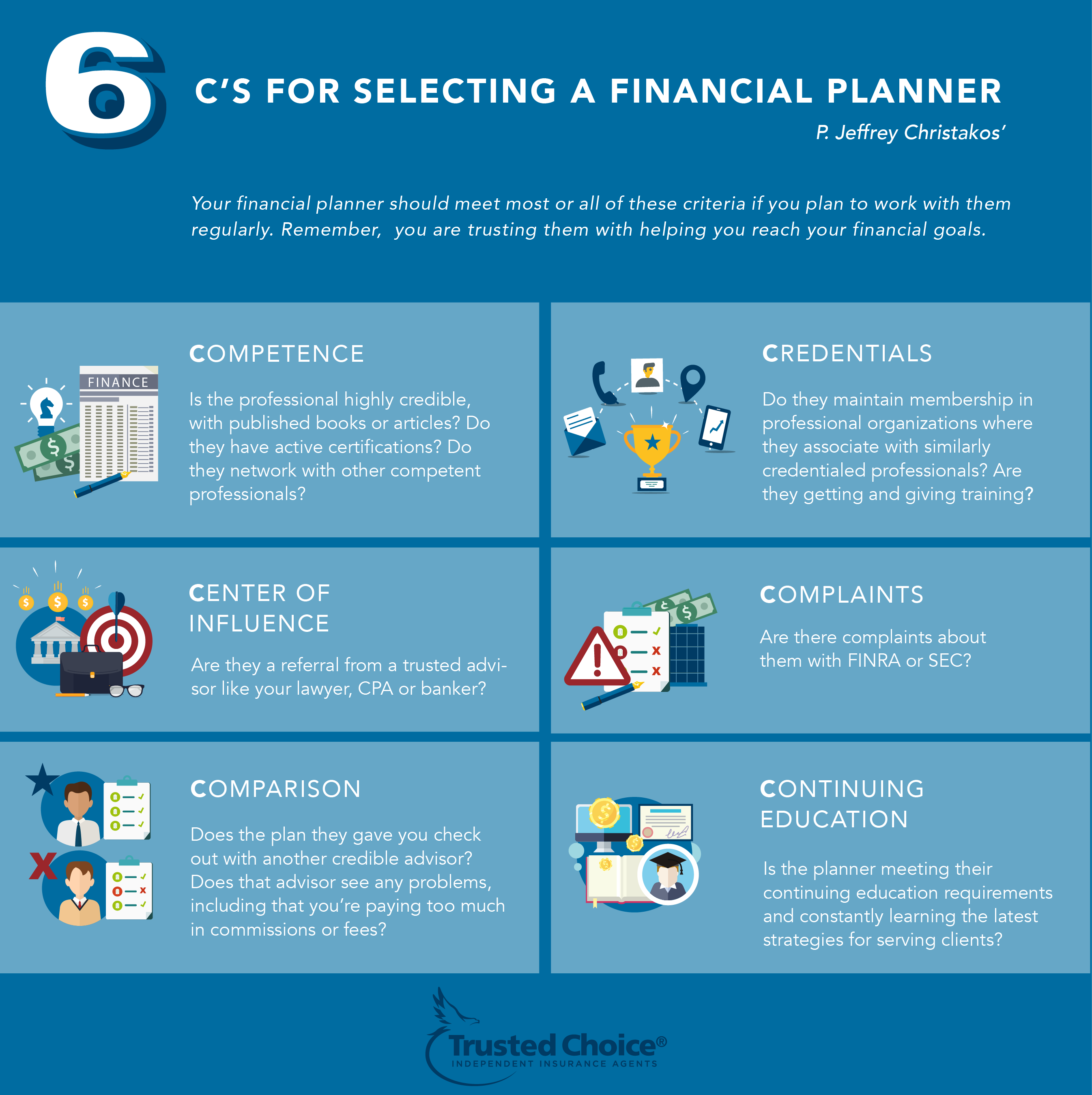

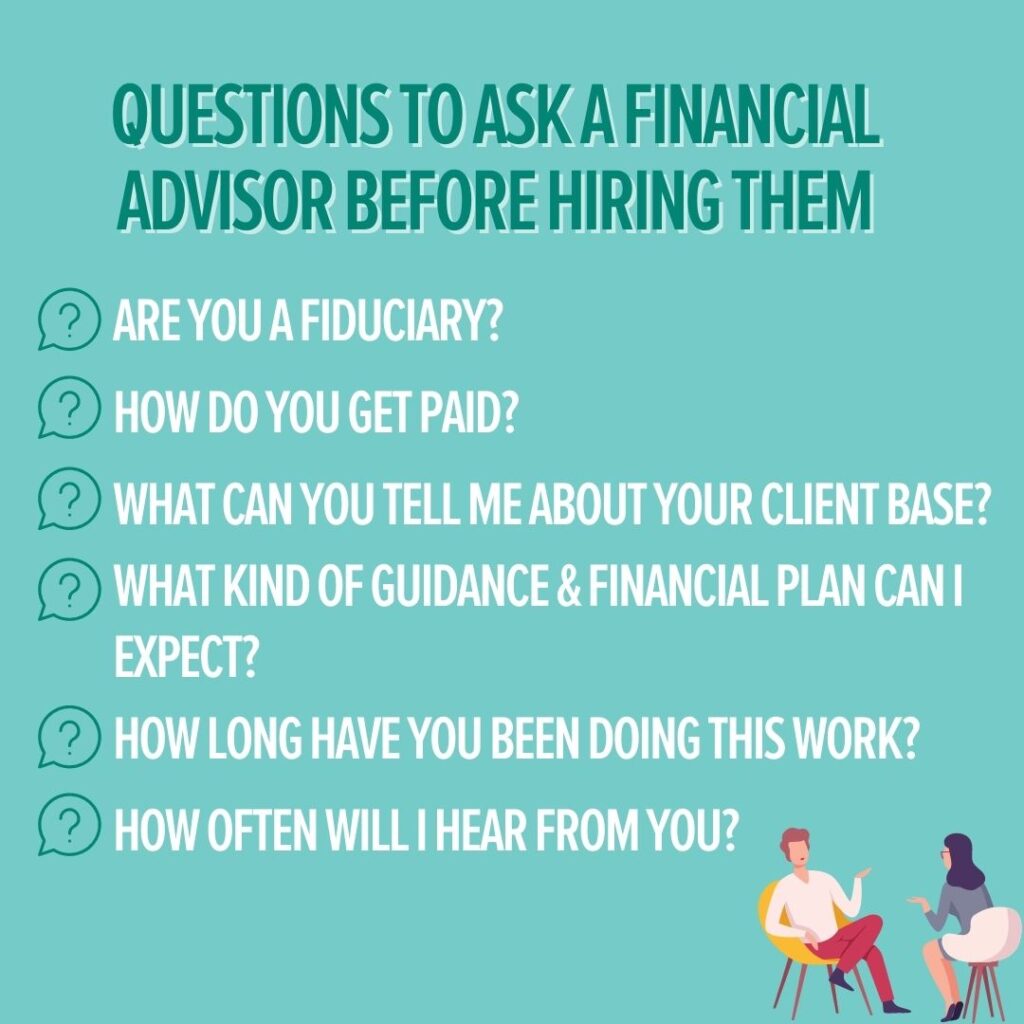

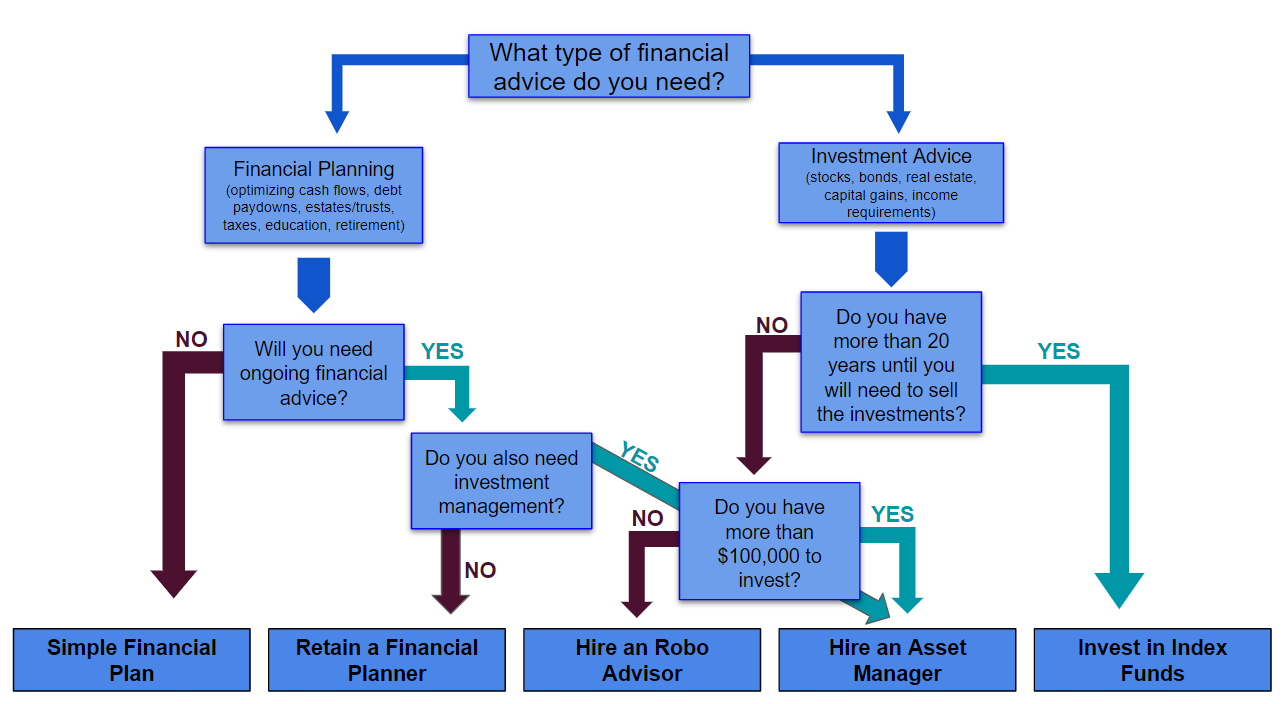

Usual reasons to take into consideration an economic expert are: If your economic scenario has come to be more intricate, or you do not have confidence in your money-managing skills. Conserving or browsing significant life occasions like marital relationship, divorce, youngsters, inheritance, or job change that may significantly affect your monetary situation. Browsing the change from conserving for retirement to maintaining riches during retired life and just how to create a strong retirement earnings plan.New innovation has led to even more detailed automated economic devices, like robo-advisors. It's up to you to explore and identify the right fit - https://hearthis.at/blanca-rush/set/clark-wealth-partners/. Ultimately, an excellent economic consultant should be as conscious of your financial investments as they are with their own, preventing extreme charges, saving money on tax obligations, and being as clear as feasible concerning your gains and losses

The 9-Minute Rule for Clark Wealth Partners

Gaining a compensation on product recommendations does not always indicate your fee-based advisor functions against your ideal passions. They may be extra inclined to recommend items and services on which they make a commission, which may or might not be in your best passion. A fiduciary is lawfully bound to place their client's rate of interests first.

They may follow a freely checked "suitability" criterion if they're not registered fiduciaries. This conventional permits them to make suggestions for financial investments and services as long as they suit their customer's goals, danger resistance, and economic scenario. This can equate to referrals that will additionally earn them cash. On the other hand, fiduciary experts are lawfully bound to act in their client's best passion as opposed to their own.

Top Guidelines Of Clark Wealth Partners

ExperienceTessa reported on all points spending deep-diving right into complex monetary subjects, losing light on lesser-known investment methods, and revealing means viewers can function the system to their advantage. As a personal finance specialist in her 20s, Tessa is acutely knowledgeable about the influences time and uncertainty carry your investment choices.

It was a targeted advertisement, and it worked. Read extra Review less.

Clark Wealth Partners Things To Know Before You Get This

There's no single course to ending up being one, with some individuals starting in financial or insurance, while others begin in bookkeeping. A four-year degree gives a strong foundation for careers in financial investments, budgeting, and client services.

Some Known Facts About Clark Wealth Partners.

Typical instances consist of the FINRA Series 7 and Collection 65 exams for protections, or a state-issued insurance license for offering life or medical insurance. While credentials may not be legitimately required for all intending roles, employers and clients typically view them as a benchmark of expertise. We check out optional credentials in the following area.

The majority of economic coordinators have 1-3 years of experience and knowledge with economic products, conformity requirements, and direct client communication. A strong academic history is essential, however experience shows the capacity to apply concept in real-world settings. Some programs incorporate both, enabling you to finish coursework while gaining monitored hours with internships and practicums.

See This Report about Clark Wealth Partners

Early years can bring long hours, pressure to build a client base, and the need to continuously confirm company website your proficiency. Financial planners enjoy the possibility to function carefully with customers, guide essential life choices, and often accomplish adaptability in routines or self-employment.

They invested much less time on the client-facing side of the sector. Almost all monetary supervisors hold a bachelor's level, and numerous have an MBA or comparable graduate degree.

More About Clark Wealth Partners

Optional qualifications, such as the CFP, typically require additional coursework and testing, which can prolong the timeline by a couple of years. According to the Bureau of Labor Stats, individual monetary advisors make a typical yearly yearly wage of $102,140, with leading earners earning over $239,000.

In various other provinces, there are policies that require them to fulfill specific needs to utilize the financial advisor or monetary coordinator titles. For monetary organizers, there are 3 common classifications: Certified, Personal and Registered Financial Coordinator.

The Single Strategy To Use For Clark Wealth Partners

Those on income might have a motivation to promote the products and solutions their employers offer. Where to locate a financial expert will depend on the kind of advice you need. These establishments have personnel that may aid you comprehend and get specific types of investments. For instance, term down payments, guaranteed investment certificates (GICs) and mutual funds.